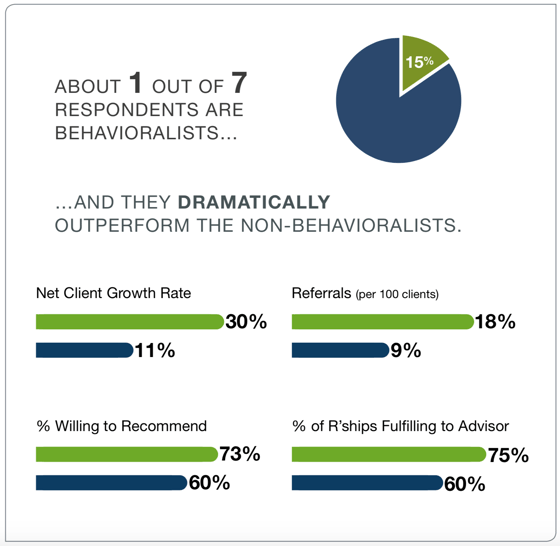

As I mentioned in my last post, we spotted a very high performing segment of advisor we came to call the Behavioralist. These advisors blend soft skills with new, behavioral client diagnostics — and they are dramatically outperforming their peers. (see chart below)

They are an interesting cohort—early tech adopters who provoke their clients in particular ways (more on that below). Only about 1 in 7 advisors are Behavioralists, but they outpace their non-Behavioralist peers in business health, client relationship quality and job satisfaction.

What are these Behavioralists doing differently? From the data, and by interviewing them, we know they excel at balancing the human and the technical. They are taking greater advantage of cutting-edge science and technology (such as data aggregation and revealed preferences tools) to get a more evidence-based, holistic picture of client’s actual financial behaviors and underlying values and preferences.

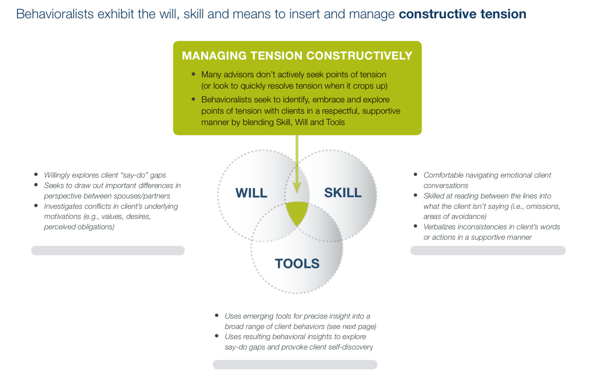

Of course, they also listen to what clients say—but they really differentiate themselves in what they listen for. They are hunting for “Say-Do” gaps—where a client’s behavior is misaligned with what the client says or thinks. When Behavioralists find these Say-Do gaps, they use the tension constructively to help clients take meaningful steps in these areas of misalignment.

Here are a few examples of Say-Do gaps that Behavioralists look for:

- Stated vs. Actual Spending—comparing what a client says about how they spend money against the client’s actual historical spending using data aggregation and real-time spend tools

- Stated vs. Revealed Preferences—comparing what a client says about their risk tolerance to what their decisions show (via revealed preferences tools—see below) can reveal presence of loss aversion and other tendencies the client would never have been able to self-report

- Shadow and Phantom Goals—hidden goals or values that actually drive behavior and spending that a client isn’t self-aware enough to appreciate OR goals clients claim to have but actual spending and behavior reveal aren’t all that important

Behavioralists are, in essence, skilled facilitators with unprecedented depth of insight into client behavior. They use that understanding to facilitate client growth and develop better plans and healthier working relationships, which are ultimately more enduring and fulfilling.

In the next post, I’ll share what we learned about the toolset that Behavioralists are using.