The Pain of Poor Diagnostics

As an advisor, it doesn't feel good to be in the dark. At least, not in wobbly markets. Because conventional risk tolerance questionnaires are blunt, imprecise tools and rely only on client’s stated preferences, they don't have the “machinery” to do a good job of detecting loss aversion (let alone measuring it). The first time you realize a client is loss averse may be when they are on the phone telling you to sell to stanch the losses...at precisely the wrong time to be selling. Or, worse, they may take their money elsewhere altogether.

Measuring Loss Aversion and the Highest Standards of Suitability and Fit

The only defense is to measure for Loss Aversion and Portfolio Fit using economic science. Dr. Shachar Kariv has pioneered gamified methods that let advisors measure loss aversion, separately from risk tolerance. Clients play through a series of simple, but carefully crafted, risk vs. reward scenarios that replicate changing markets and are pure enough to expose their true preferences. In each scenario, they are presented with a graphical interface—a digital "slider"—to choose the point on a risk-reward continuum that feels most comfortable to them. One of Dr. Kariv's most important inventions is this graphical interface, which lets clients show us, not tell us, what they would do. The interface can be seen at www.TrueProfile.com and is used in the TrueProfile platform. This is the key to precisely understanding a client's preferences in terms of dollars and cents.

Find Loss Aversion Before It Finds You

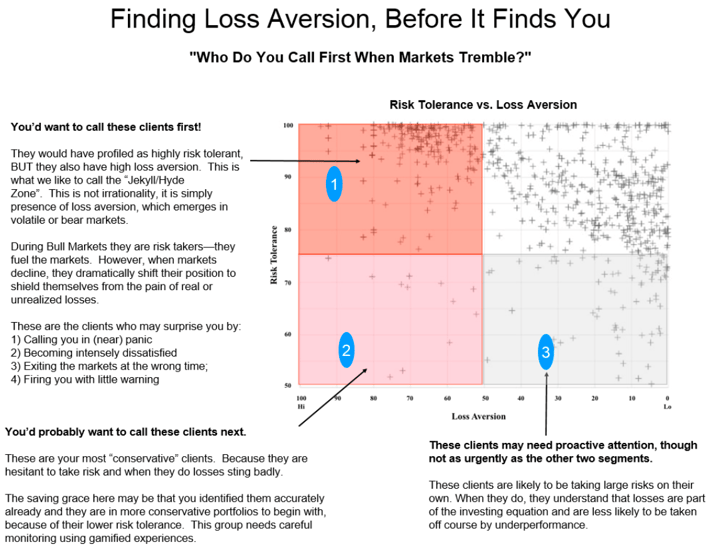

Ignoring Loss Aversion when the technology is available is a sin of commission, not omission. In his Applied Behavioral Economics for Financial Advisors course, Kariv likes to display the graphic below (without the annotation), and ask students, "Can you find loss aversion, before it finds you?", or "Who would you call first when markets tremble?"

Well, you'd want to call clients who are highly risk tolerant, but also highly loss averse—those in the upper left quadrant. They are the ones who were most tempted to take risk, but who feel losses most painfully. Call them—to educate, hold their hand, and get in front of the loss aversion—before they call you.

Swimming naked can be exhilarating, but when the tide goes out, it's nice to have the wetsuit.

-1.png?noresize&width=174&name=1%20(2)-1.png)