On Christmas Day in 1895, William Roentgen—the inventor of the x-ray—sent an x-ray image of his wife's hand around the world. (Note: you don't want BillyR as your Secret Santa...weird taste in gift giving).

Within six months, carnival and opera-goers were having x-ray images taken for novelty (!). At the same time, "radiographs" were being used to find bullets lodged in soldiers.

By 1900, early adopter physicians deemed x-ray imaging essential for clinical care, especially for diagnosing presence of foreign bodies and bone fractures. In that year, less than 10% of patients presenting to the Pennsylvania Hospital with a bone fracture or break had their x-ray taken. But by 1920, over 90% of such patients received an x-ray.

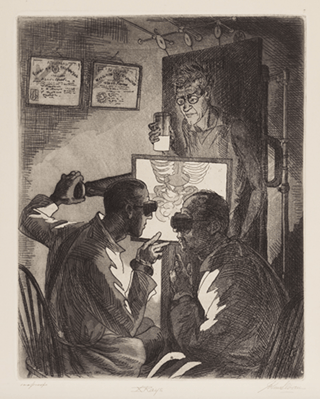

John Sloan (1871−1951), X-rays, 1926.

Twenty years was a remarkably short time for full adoption of the x-ray, especially given the (lengthy) adoption timeline of new technologies 120 years ago. How did the x-ray come to such widespread use in so short a time?

Quite simply:

"It was a less painful method of diagnosis for the patient than the traditional use of manual manipulation of the suspected broken bone, and potentially a more precise and modern technique for the physician."

--Joel J. Howell, MD, Ph.D Early Clinical Use of the X-Ray

And that is where we see the parallel to financial advice.

Behavioral economic methods will offer the same kind of client diagnostic revolution in financial advice that medicine experienced at the turn of the 19th century.

The key invention here—the financial "x-ray"—is a graphical interface that lets clients show what their true preferences are. Pioneered by Dr. Shachar Kariv of UC Berkeley, and detailed in his 2007 paper in the American Economic Review Revealing Preferences Graphically: An Old Method Gets a New Toolkit, it's the equivalent of putting clients in a financial decision-making wind tunnel.

These methods are far less "painful" for clients when attempting to discern their true preferences—they take far less time (a matter of minutes) and are much more engaging and intuitive for clients than risk tolerance questionnaires. Moreover, these methods allow radically greater precision in patient understanding--"a more precise and modern technique" for the advisor.

So now, we'll ask the "magic wand" question that only inventors or theorists typically think to ask:

If you could wave a magic wand, and have at your fingertips any information you liked about a client (patient), what exactly would you want to know?

In other words, what comprises a holistic understanding of a client (patient)?

We'll look to classic economics as we take on that important question in our next post.

To learn more about the new science of client understanding, and the toolset that will unlock that understanding, visit www.TrueProfile.com/the-Science.