I’ll cut right to it. We conducted a unique, international benchmarking study of financial advisors, and I want to share some of the key findings with you, starting with this blog post (with more to come). If you’re an advisor reading this, the data-backed findings have implications for the quality of your client relationships, the health of your business and your own personal fulfillment!

The findings are striking—we’re talking differences of 50% to 100% in metrics like client willingness to recommend, referral rates, net client growth rates and advisor job satisfaction.

Ok, take a step back. What’s this study all about?

The study benchmarks over 80 “know your client” (KYC) Building Blocks, each a distinct behavior, method, tool or skill that advisors can employ to understand their clients. Building blocks range from how advisors understand client goals and preferences, to how they manage family dynamics, to how they apply insights from understanding clients to deliver a better client experience.

At the same time, we gathered data on performance indicators—client relationship quality (referral rates and likelihood to recommend); business health (net client growth rate and referral rates) and advisor satisfaction (percentage of client relationships that are a source of personal fulfillment for the planner). By marrying the Building Block data with the performance data, we were able to pinpoint which groups of Building Blocks seem to matter most when it comes to performance.

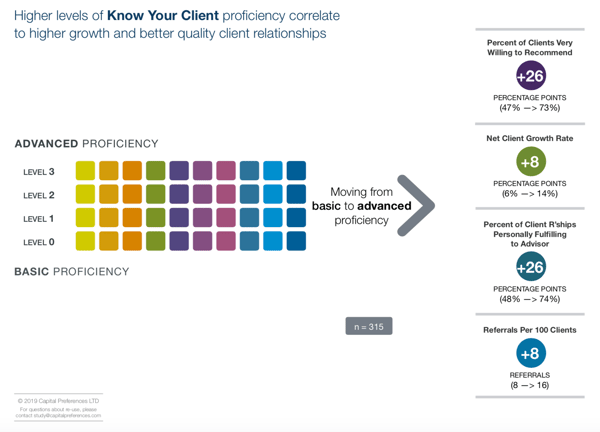

Guided by deep interviews with over 40 seasoned planners and domain experts, plus extensive secondary research, we sorted the 80 Building Blocks into four levels of proficiency. Each level indicates greater Know Your Client proficiency, and as it turns out, is highly correlated with key performance indicators. We found that planners who operate at Level 3 (advanced proficiency), when compared to those at Level 0 (basic proficiency), do better.

- Client relationship quality: 73% of clients willing to recommend (Level 3) vs. 47% (Level 0)

- Business health: 14% net client growth rate vs. 6%; double the referral rate (!)

- Advisor satisfaction: 74% of client relationships personally fulfilling vs. 48%

These correlations suggest that the advisor who knows the client best, wins. But I’m sure you’re wondering, which KYC building blocks matter most? How does an advisor boost proficiency in those areas?

It turns out it isn’t any one building block, rather it’s clusters of them. By studying these clusters, we were able to spot some very interesting trends. I’ll unpack these insights in upcoming blog posts. In the next post, I’ll detail the emergence of a very high performing segment of planner that we came to call the Behavioralist. They are an interesting cohort—early tech adopters who provoke and challenge their clients in particular ways.

Benchmarking is now re-opened for those who would like to see how their KYC behaviors stack up to peers—over 400 advisors (and counting) who have now participated. Client-facing financial planners and advisors of all stripes are invited to participate. KYC Benchmarking Survey